SUMMARY

Deductions are fees that can be taken off-the-top (before the broker/agent split) or paid from the broker or agent share of commission. Off-the-top (OTT) deductions can be paid to the broker, in-house agents or third parties (e.g. Charitable Contribution, Client Rebate, Home Warranty, Payment to Assistant or TC, etc.). Regular deductions can be paid to in-house agents or third parties. Once deductions have been set up by a master admin on the Deductions page, those deductions can be applied when managing commissions on transactions.

Manage Deductions

Master admins can easily manage deductions on the Deductions page.

To get to the Deductions page:

- Click your name in the upper right corner then [Admin / Settings].

- Select [Deductions] from the Financials section of the left menu.

Only master admins can view and manage deductions.

Setup Deductions

To add deductions:

- Go to the Deductions page →

- For each deduction, type the deduction name in the Deduction Name column.

- In the Default Amount column, enter the standard amount for the deduction. The amount you enter here will be inserted for that deduction when managing commissions on transactions. You can change the amount during that process for any individual transaction, if needed.

If the deduction varies from transaction to transaction, leave the deduction amount blank.

- Choose [%] or [$] to specify whether your default amount will be based on a percent or dollar amount.

- If you selected the [%] option, select the deduction percent basis in the next column to specify the value on which to calculate the percentage. Off-the-top (OTT) deductions can be calculated as a percentage of Gross Commission or Sale Price. Regular deductions can be calculated as a percentage of Gross Commission, Sale Price, Distributable Commission, Broker Gross, Agent Gross, or Gross Commission less Referral Commission.

- Click [Save Settings].

When managing commissions on transactions later, default deduction amounts will auto-populate but can be updated or deleted as needed.

Delete Deductions

To delete deductions:

- Go to the Deductions page →

- From the Deductions page, remove the Deduction Name that needs to be deleted.

- Click [Save Settings].

Enable off-the-Top Deductions

To apply off-the-top (OTT) deductions on transactions, off-the-top deductions will need to be enabled in Commission & CDA Settings.

To enable off-the-Top Deductions:

- Navigate to Commission & CDA Settings →

- Check the box next to, [Allow off-the-top deductions].

- Click [Save Settings].

Apply off-the-Top Deductions

When managing commissions on a transaction, in the Sale Info section, deductions can be taken off-the-top (OTT) of commissions and paid to the broker, agents, or external recipients. This will allow the broker and agent gross commission amounts to reflect any deductions taken prior to distributing commission.

The OTT deductions can be a flat dollar amount or based on a percentage of Gross Commission or Sale Price. You can set these OTT deduction amounts to have default values or enter them at the time of CDA generation.

When managing commission on a transaction, if you are taking an off-the top deduction that's based on a percentage other than Sales Price or Gross Commission (e.g., Broker Gross or Agent Gross), you'll only be able to take that off-the top deduction as a flat dollar amount since the other percent bases can not yet be calculated.

To apply OTT deductions:

- Ensure off-the-top deductions are enabled →

- From a transaction's Manage Commissions page, select the [Enter off-the-top deductions] dropdown and select your desired deduction type.

- Enter the fee amount or use the default amount populated (if applicable). You may also modify the default amount if needed.

- Select and enter the appropriate payee information (external, in-house, or broker).

- Once complete, if needed, you can repeat these steps to enter another off-the-top deduction.

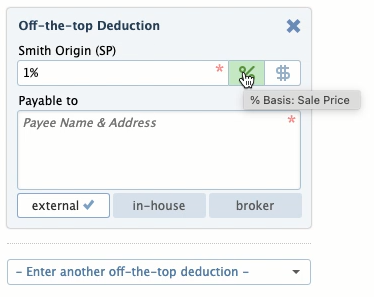

To view the percentage basis set for a deduction, hover over the deduction's [%] option.

Learn how to Manage Commissions on a Transaction →

Apply Broker or Agent Deductions

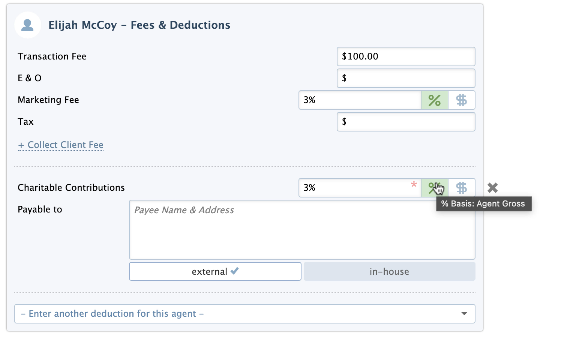

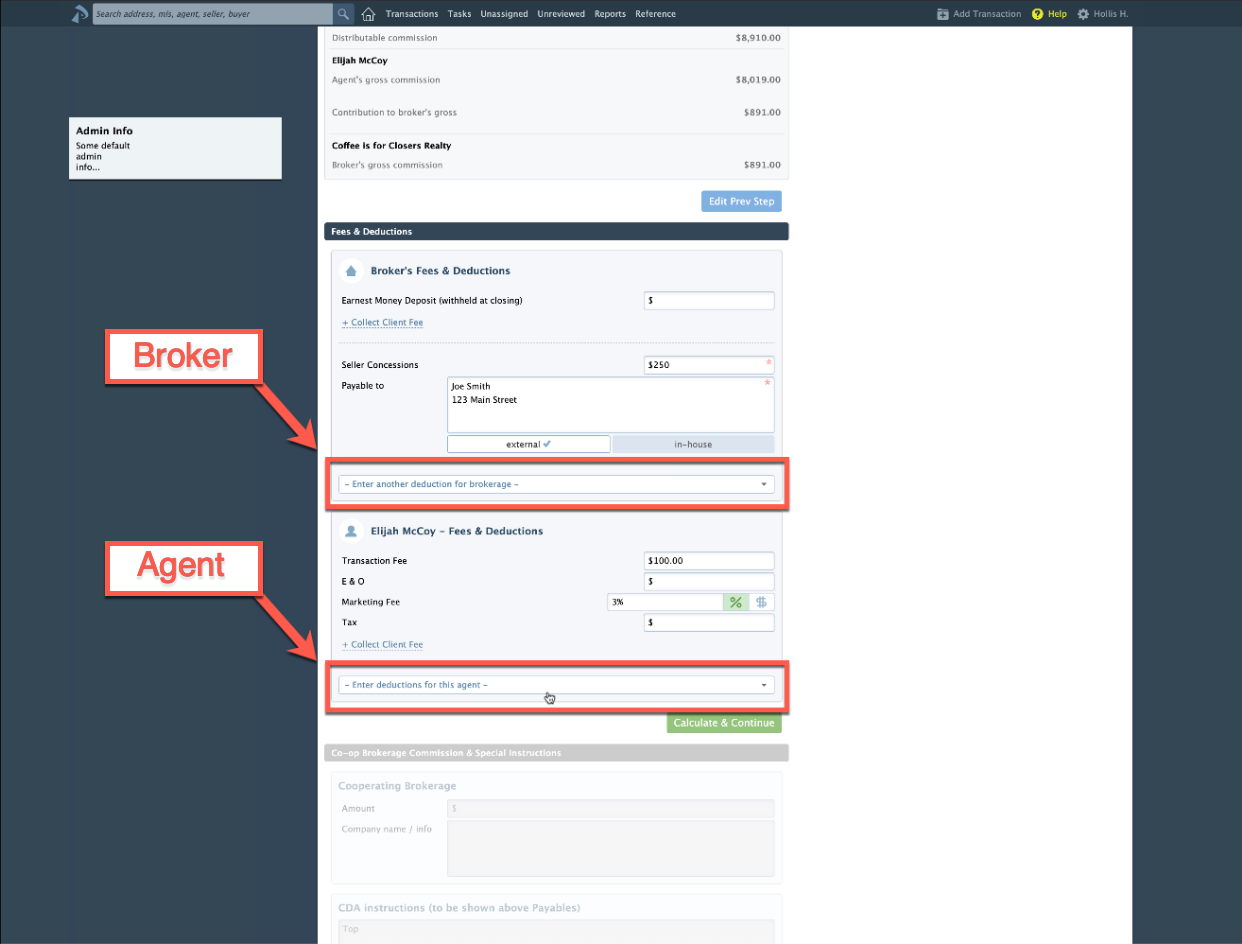

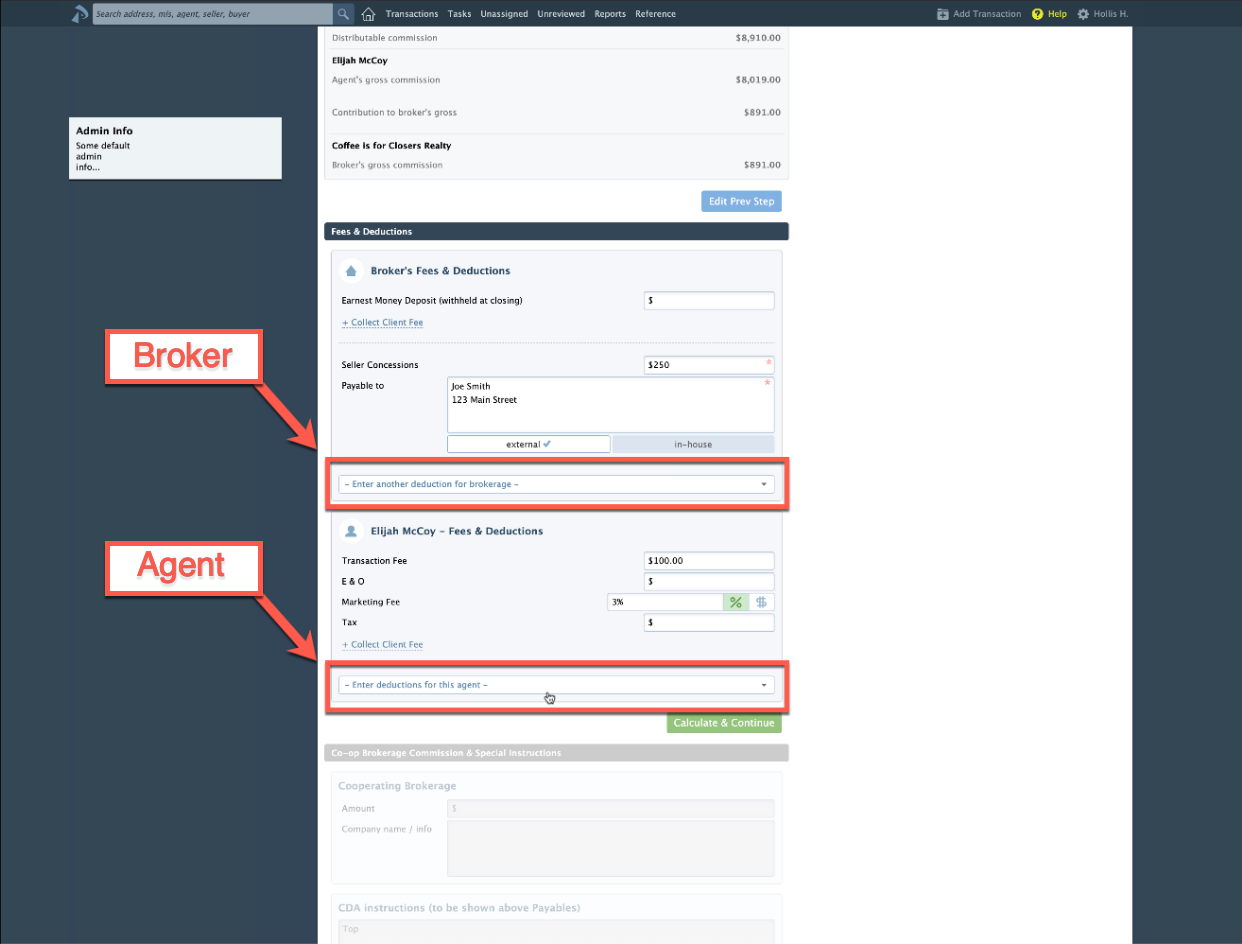

When managing commissions on a transaction, in the Fees & Deductions section, deductions can be charged to the brokerage or agents and paid to in-house or external recipients.

The deductions can be a flat dollar amount or based on a percentage of Sale Price, Gross Commission, Distributable Commission, Broker Gross, Agent Gross, and Gross Commission less Referral Commission. You can set these deduction amounts to have default values or enter them at the time of CDA generation.

To apply broker or agent deductions:

- From a transaction's Manage Commissions page, select the [Enter deduction for brokerage] or the [Enter deduction for this agent] dropdown and select your desired deduction type.

- Enter the fee amount or use the default amount populated (if applicable). You may also modify the default amount if needed.

- Select and enter the appropriate payee information (external or in-house).

- Once complete, if needed, you can repeat these steps to enter another deduction.

To view the percentage basis set for a deduction, hover over the deduction's [%] option.